Bureau of Internal Revenue (BIR) is urging the taxpaying public not to patronize and obtain their Taxpayer Identification Number (TIN) and/or TIN Card from online sellers.

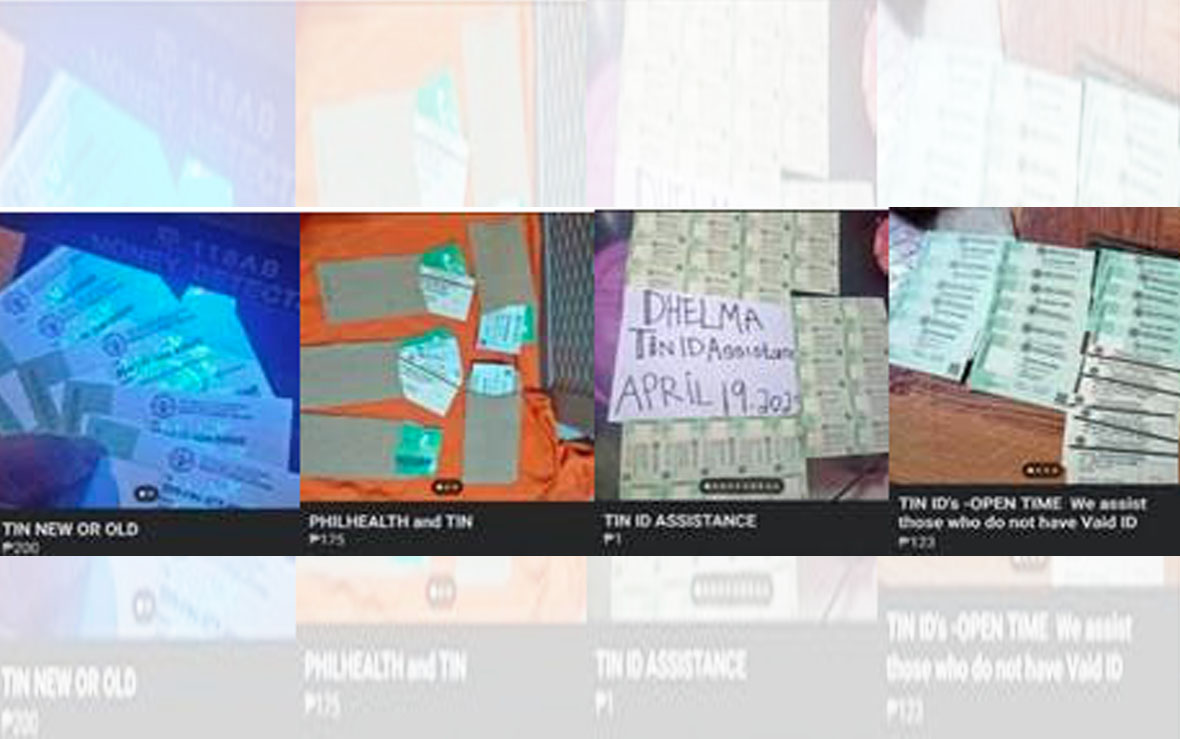

Recently, the BIR has discovered several “enterprising” individuals offering “BIR TIN ID ASSISTANCE” via Facebook, Shopee, Lazada and other online selling platforms.

“These offers of TIN ID Assistance posted in online channels/selling platforms are not authorized by the BIR and are, therefore, considered ILLEGAL. Please do not be deceived or misled by such offers,” said Commissioner Romeo D. Lumagui, Jr.

The BIR, through its Client Support Service, has conducted a dialogue with representatives of Shopee and Lazada on May 31, 2023 to call their attention on such illegal activities, and to request them to immediately remove all advertisements/postings offering TIN ID assistance.

Several entrapment operations and arrests of sellers of TIN ID Assistance services were also made by the BIR regional and district offices since 2019 in Laoac, Pangasinan; Cebu City; Bukidnon; Gumaca, Quezon; Pila, Cabuyao and Sta. Rosa, Laguna; and Cordillera Administrative Region. The offenders were apprehended, and legal proceedings were initiated to ensure that appropriate penalties were imposed on them. Said arrests and filing of criminal cases highlight the seriousness of the BIR in addressing the proliferation of unauthorized TIN issuance and selling of TIN Cards.

“TIN CARDS ARE NOT FOR SALE, and are only issued/released by the BIR through its authorized personnel. DO NOT get TIN or TIN Cards from unauthorized BIR personnel, non-BIR personnel or through Facebook, Shopee, Lazada and other online selling platforms, because they are considered illegal, fraudulent and FAKE,” said Commissioner Lumagui.

Getting a TIN or TIN Card is FREE OF CHARGE and does not require third-party services for it to be issued. The ID Card is an accountable form and selling and faking it is punishable by a fine and imprisonment under Section 257 of the Tax Code of 1997, as amended.

Selling of TIN Card and TIN services not only poses serious legal implications but also undermines the integrity of the taxation system and the revenue-generation efforts of the BIR. These illicit activities may lead to identity theft, tax fraud, and other unlawful activities that could harm both individuals (who will avail of such services) and the economy as a whole.

To ensure the authenticity and legitimacy of the TIN and TIN Card being issued, the Commissioner advises individuals to transact only with authorized revenue personnel at the Revenue District Office (RDO) having jurisdiction over their residence, and to follow the established process for obtaining both. He also reminds everyone to exercise caution when giving their personal information online to prevent identity theft and other cybercrimes.

“The BIR remains committed to protecting the integrity of the taxation system and ensuring compliance with tax regulations. We urge the public to cooperate and report any sellers of TIN or TIN ID to the BIR through our Hotline number (02) 8538-3200 or via email at [email protected]. By reporting such activities, you are helping the BIR put a stop to this unlawful practice”, Commissioner Lumagui said.