UMABOT na sa P1.9 trillion ang revenue collections ng national government sa first half ng taon, ayon kay Finance Secretary Benjamin Diokno.

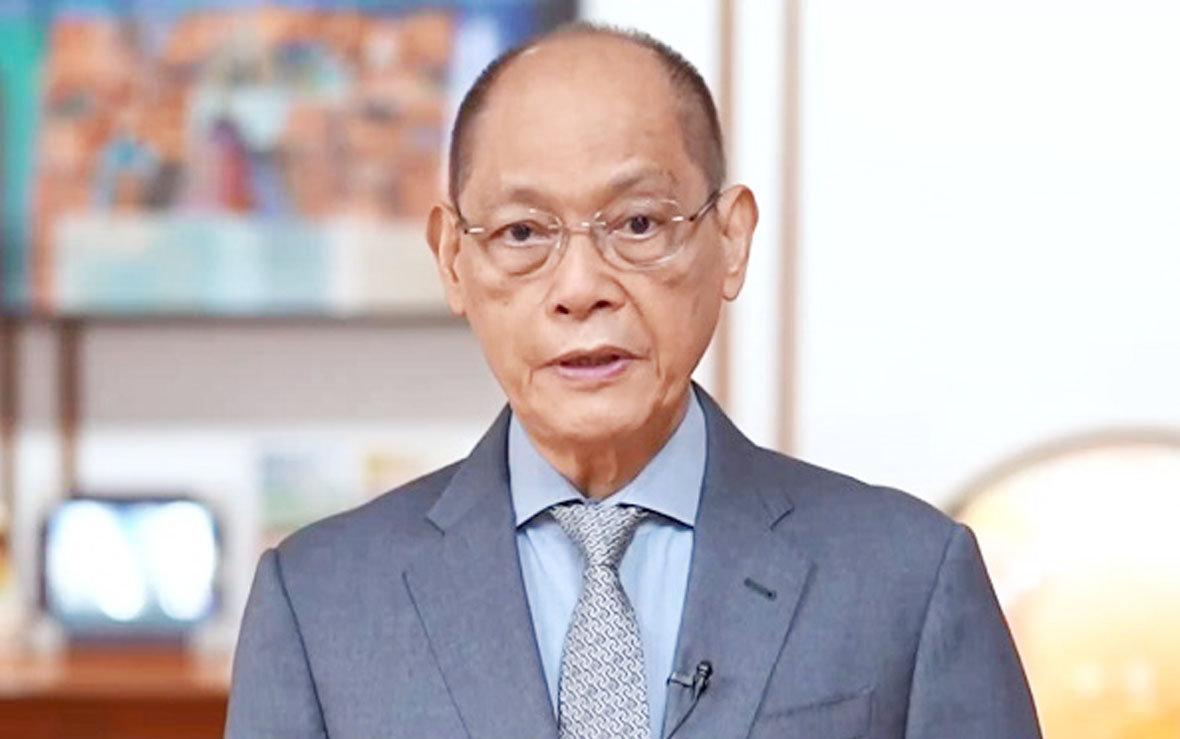

Sa kanyang talumpati sa post-State of the Nation Address (SONA) sa Philippine International Convention Center (PICC) sa Pasay City nitong Martes, sinabi ni Diokno na ang revenue collections mula January hanggang June ay mas mataas ng P133 billion o 7.7 percent kumpara noong nakaraang taon.

Ang tax collections ay tumaas ng 7.5 percent habang ang non-tax collections ay lumago ng 9.1 percent.

“Our stellar performance was the result of higher economic activity and efficiency gains from the digital transformation of our revenue agencies,” ani Diokno.

“The digitalization of the Bureau of Internal Revenue and the Bureau of Customs have continued to maximize the government’s revenue potential, simplify taxpayer compliance, and improve the ease of doing business.”

Sa ilalim ng medium-term fiscal program ng pamahalaan, tinatayang ang revenues ay aabot sa P3.73 trillion ngayong taon.

Tinatayang tataas ito sa P4.20 trillion sa 2024; P4.69 trillion sa 2025; P5.25 trillion sa 2026; P5.89 trillion sa 2027; at P6.62 trillion sa 2028.

“Sustaining robust revenue collection requires a simpler, fairer, and more efficient tax system, reinforced by a combination of tax policy and tax administration measures,” ayon kay Diokno.

Sinabi ni BIR Commissioner Romeo Lumagui Jr. na kumpiyansa siyang makakamit ng BIR ang revenue collection target nito ngayong taon.

“We are very hopeful that we will meet our collection target, especially with all the programs we initiated. We laid down the programs we want to implement in the bureau,” pahayag ni Lumagui sa sidelines ng post-SONA.

Para sa taong ito, target ng BIR na makakolekta ng kabuuang P2.6 trillion.

Sinabi ni Lumagui na tinutugunan ng ahensiya ang mga balakid upang mapag-ibayo ang pangongolekta ng buwis.

“We have four focus areas. (To provide) excellent taxpayers service, we’ve been doing the rounds, we’ve already determined the bottlenecks in majority of the transactions being made, and that’s why we’re trying to translate that to online services so you will not need to go to our offices,” anang BIR chief.

Aniya, ang mga focus area na ito ay ang pagpapaigting sa enforcement activities, taxpayer service, integrity and professionalism, at digitalization.

-PNA