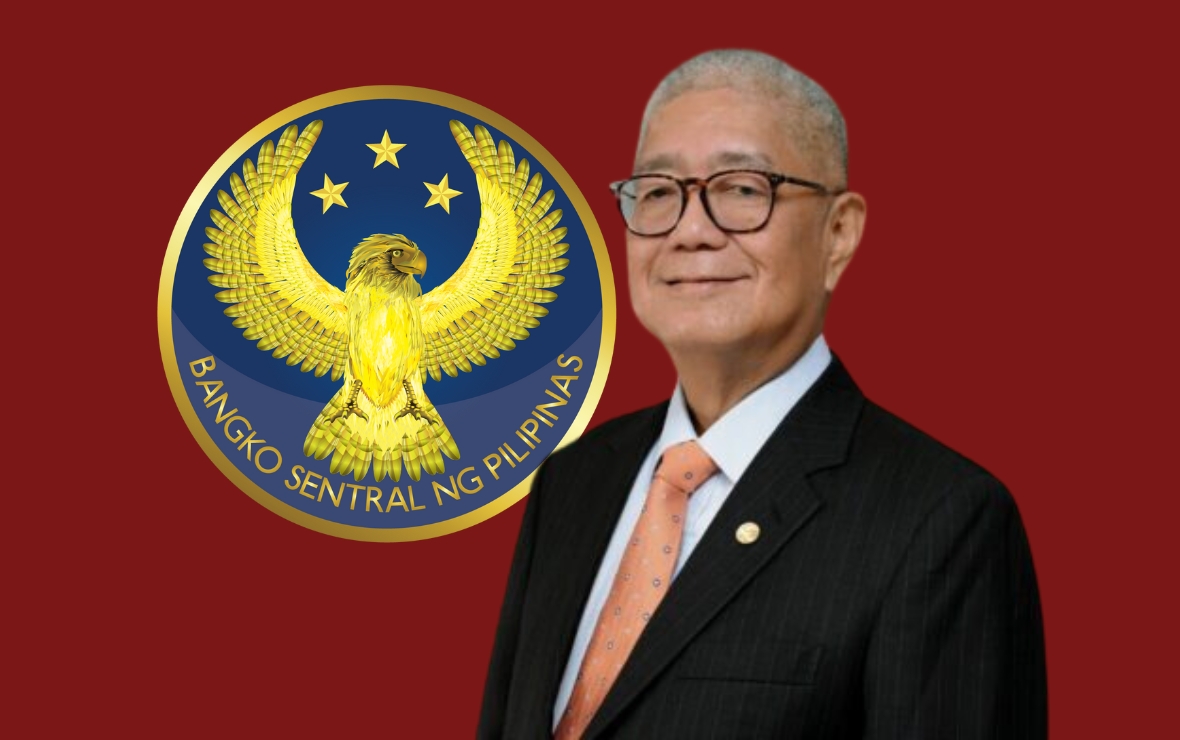

KUMPIYANSA si Bangko Sentral ng Pilipinas (BSP) Governor Eli Remolona Jr. na posible ang rate cut ngayong taon.

“Oo naman. Within the year, oo but maybe [the] first semester is too soon. But we’ll see with the numbers,” pahayag ni Remolona sa sidelines ng annual reception para sa banking community noong Biyernes.

Magmula noong Mayo 2022, ang BSP ay nakapagtaaa na ng benchmark rates ng kabuuang 450 basis points upang mapahupa ang tumataas na inflation.

Pinanatili ng Monetary Board ng BSP ang policy rates sa kanilang huling dalawang sunod na pagpupulong noong 2023.

Ayon kay Remolona, ang January 2024 headline inflation rate ay posibleng isang “low number dahil sa base effects.”

“So you have to (kind of) adjust for base effects because the January number will be measured relative to January 2023. The January 2023 was high at 8.7 percent, so because of that, the number that will come out in January might be a bit low. And then, babawi ‘yun sa (it might go up in the) second quarter, so second quarter numbers may be a bit high, so we have to adjust for that,” aniya.

Ang headline inflation ay bumagal pa sa 3.9 percent noong December 2023, na sa wakas ay pasok sa 2-4 percent target range ng gobyerno.

Ito ang pinakamababa magmula nang maitala ang 3 percent noong February 2022.

Ang official January 2024 headline inflation data ay ilalabas sa unang linggo ng Pebrero.

(PNA)